Does Homeowners Insurance Cover Sidewalk Repair

Homeowners accept to consider all kinds of potential hazards that could happen on their property, including third-party injuries. Then what happens if someone slips and falls on your icy sidewalk? We'll tell y'all. We'll also tell y'all if you're covered.

Fortunately, an independent insurance agent can help you consider any risks before they ever happen, from the common to the obscure. They've seen and handled all kinds of claims, and they know how to claw you up with the exact protection you lot need, long before you ever need it. Here's how they'd help y'all become covered in the effect someone slips on your icy sidewalk.

What Happens if Someone Slips on My Sidewalk and Gets Injured?

Well for starters, you lot could get sued. Withal, information technology may come as a relief that you're non likely to be held liable for someone getting injured on your icy sidewalk, because atmospheric precipitation is an act of nature. That being said, in that location are a couple of scenarios in which y'all could exist deemed responsible for your frozen sidewalk, such as if runoff from your gutters freezes on your sidewalk. Certain towns likewise require homeowners to proceed sidewalks articulate of precipitation at all times.

If an injury occurs while a winter storm is in progress, no one can be held liable. Homeowners are never expected to maintain sidewalks while snow and ice is however falling. Different towns have their own requirements in place for how long a homeowner has to clear their sidewalk afterwards the storm has ended. Sometimes it's a thing of merely a couple of hours.

It'southward estimated that more than ane million Americans injure themselves due to slips and falls on snow and water ice annually. That makes it all the more important to work with your independent insurance agent to ensure that you're covered, merely in example things get glace.

When Is the Sidewalk Your Belongings vs. the City's?

Unfortunately, there'south no clear-cutting respond, other than it depends. Certain cities and towns dictate that sidewalks are public property and therefore their maintenance is upwards to the local government. However, ofttimes in non-major cities, sidewalks may still be considered public property, only maintenance responsibilities fall on the homeowner. Check out your town'southward local ordinances to confirm whether clearing your sidewalk of ice is your responsibility or not.

What Kind of Insurance Will Help Protect Me or Go Me Back on My Anxiety later on an Incident?

Your homeowners insurance policy will help protect you lot in the issue you are sued due to a third party'southward sideslip and autumn on an icy sidewalk on your property. Icy sidewalks are considered a premises exposure past domicile insurance companies and are a covered peril. Even if you're accused of negligence and end up being held liable for the blow, your homeowners insurance will help protect you through the liability coverage section of the policy.

Liability Coverage for Homeowners

If a tertiary party gets injured on your property due to a covered peril and y'all get sued, the liability coverage provided by your homeowners insurance policy volition help protect you. Whether or non you lot cease up existence held liable in court, you'll still be relying on your liability coverage to pay for legal fees.

Liability coverage protects homeowners in the following ways:

- Payment of legal fees: Liability coverage reimburses homeowners for courtroom and chaser fees, as well as whatsoever settlements they're ordered to pay in the effect they are held responsible for an incident such as someone slipping on their sidewalk.

- Medical payments: Liability coverage also takes intendance of fees associated with treating any tertiary-party injuries that occur on your property due to a covered peril, like an icy sidewalk.

Lawsuits are plenty of a hassle in the first identify, and whether or not you're held responsible for an incident similar someone slipping on your icy sidewalk, liability coverage seriously helps to accept intendance of the fiscal repercussions.

Umbrella Coverage for Homeowners

Depending on your specific dwelling house and other factors, you lot may desire to consider adding umbrella coverage to help extend your liability coverage'southward limits. Umbrella insurance is essentially backlog liability coverage that stacks on top of the underlying liability coverage provided by your homeowners policy. Umbrella insurance policies typically come with limits of $ane million in coverage.

While a skid and autumn on an icy sidewalk may non require excess liability or umbrella coverage, at that place are many common lawsuits that could hands become extremely costly. The most common lawsuits filed against homeowners other than icy walkways include the following:

- Dog bites: Fifty-fifty injuries caused past a family pet can cost an average of $xxx,000 in claim settlements.

- Fallen trees: If a tree on your property falls and amercement your neighbor's home, the resulting financial harm could easily accomplish into the ten-thousands.

- Hired help injuries: In the event a domestic worker, such as a maid or gardener, is injured on your holding due to your failure to maintain a condom premises, the resulting lawsuit and medical payments required could become expensive, fast.

- Intoxicated guests: When you throw a party and it gets a lilliputian out of hand, you as the homeowner are however held responsible for whatsoever holding damage or bodily injuries an intoxicated guest causes to other guests.

While you may not be too worried nigh icy sidewalks, it's of import to consider all the common legal risks to homeowners that could warrant an umbrella insurance policy.

Other Common Home Insurance Claims

Icy sidewalks aren't a concern for all homeowners, but knowing other risks that homeowners face up on a daily basis tin can seriously help when working with your independent insurance agent to get all the coverage you may need. Cheque out these stats regarding mutual domicile insurance claims.

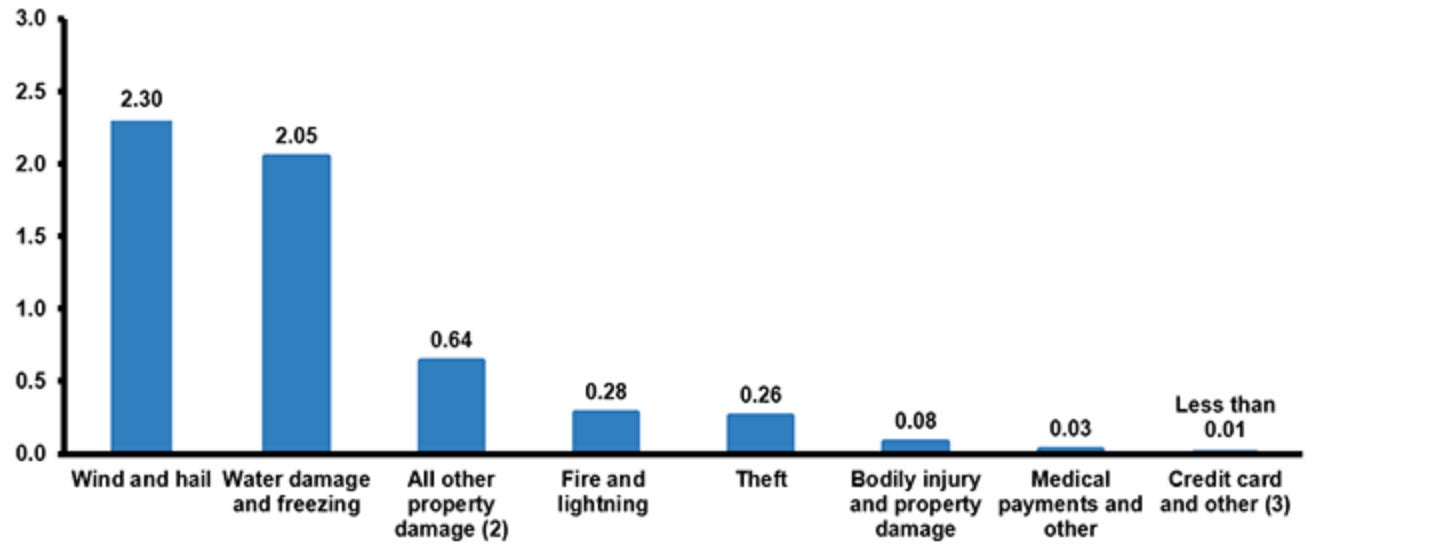

Homeowners Losses Ranked By Claims Frequency, 2022 to 2022

(Weighted boilerplate, 2022 to 2022)

(1) Claims per 100 firm years (policies). For homeowners multiple peril policies (HO-ii, HO-3, HO-5, and HE-seven for North Carolina). Excludes tenants and condominium owners policies. Excludes Alaska, Texas, and Puerto Rico.

(2) Includes vandalism and malicious mischief.

(3) Includes coverage for unauthorized use of various cards, forgery, counterfeit money, and losses non otherwise classified.

Source: ISO®, a Verisk Analytics® business.

The most commonly submitted claims by homeowners in the 2022 to 2022 catamenia were due to wind and hail impairment. Post-obit those disasters were claims made due to water damage and freezing. Property harm, burn down and lightning, and theft were too commonly reported, as were bodily injury claims, theft, medical payments, and credit bill of fare misuse.

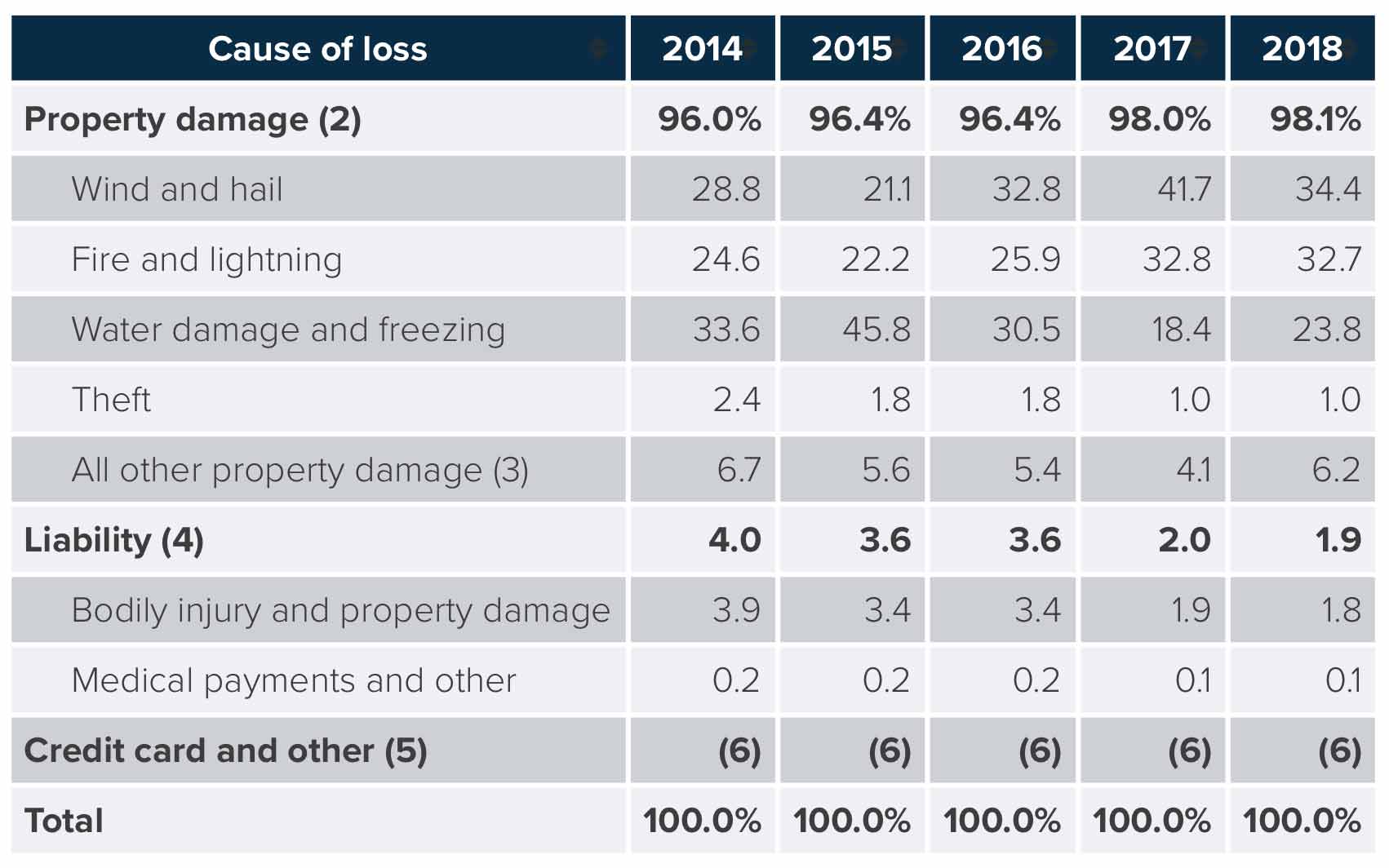

Homeowners Insurance Losses Past Cause, 2022 to 2022

(ane) For homeowners multiple peril policies (HO-2, HO-3, HO-5, and HE-7 for Northward Carolina). Excludes tenants and condominium owners policies. Excludes Alaska, Texas, and Puerto Rico.

(2) First party, i.e., covers damage to policyholder's own property.

(3) Includes vandalism and malicious mischief.

(4) Payments to others for which policyholder is responsible.

(5) Includes coverage for unauthorized use of various cards, forgery, apocryphal coin, and losses not otherwise classified.

(6) Less than 0.i percent.

Source: ISO®, a Verisk Analytics® business organisation.

Property damage claims were by far the most oft reported for home insurance between 2022 and 2022, with water damage and freezing specifically bookkeeping for 33.6% of all claims in 2022. In 2022, wind and hail claims took the top spot for frequency, accounting for 34.four% of all dwelling house claims reported that year. Liability related claims account for less than 4% of full claims each year during the observed catamenia.

Exercise I Need Actress Endorsements to Protect Me?

In the case of an injury on your icy sidewalk, no, you shouldn't need whatsoever extra endorsements to protect you. Your homeowners insurance will provide pregnant coverage for these incidents. However, there are certain scenarios when yous may desire to buy additional coverage to help protect yourself from common incidents affecting homeowners.

Homeowners often purchase the post-obit coverages in addition to home insurance:

- Home-based business endorsements: While standard homeowners policies protect against tertiary-party injuries on your holding, you're not protected if yous run a business out of your dwelling house. You lot'll need to add this endorsement if you accept a home office or studio in guild to ensure you have adequate liability coverage.

- Personal holding endorsements: Standard homeowners policies identify limits on expensive personal belongings items like jewelry and electronics. If y'all're worried about these items getting stolen, lost, damaged, or destroyed, it'south a adept idea to purchase endorsements for specific pieces you lot'd like to increase coverage limits for.

- Sewer backup endorsements: Homeowners insurance protects you against a lot of things, but typically sewage backup isn't one of them. While this incident would exist messy plenty in the offset place, non having coverage would really be a nightmare. Talk with your independent insurance agent about adding a sewer backup endorsement to your coverage.

- Alluvion insurance : Many natural disasters are covered under standard homeowners insurance policies, but floods aren't one of them. If you live in an area prone to flooding, you'll want to purchase a inundation insurance policy to protect your habitation confronting impairment or destruction due to flood waters.

- Convulsion insurance : Besides known as earth move policies, this coverage protects homeowners against home impairment due to earthquakes, mudslides, and other related natural events. Standard homeowners policies do not provide coverage for these types of disasters.

Your independent insurance amanuensis can help you lot address any remaining coverage concerns you may take. They'll make sure y'all get set up upwardly with all the protection you could perchance need against many dissimilar kinds of unforeseen disasters.

Hither'south How an Independent Insurance Agent Would Aid

When it comes to protecting tertiary parties against slips on an icy sidewalk and all other foreign incidents, no ane's better equipped to help than an independent insurance agent. Independent insurance agents search through multiple carriers to find providers who specialize in homeowners and all other forms of insurance, deliver quotes from a number of dissimilar sources, and assist you walk through them all to notice the all-time blend of coverage and toll.

Does Homeowners Insurance Cover Sidewalk Repair,

Source: https://www.trustedchoice.com/insurance-articles/home-family/icy-sidewalks/

Posted by: alvaradoholf1975.blogspot.com

0 Response to "Does Homeowners Insurance Cover Sidewalk Repair"

Post a Comment